In an era where technology evolves at an unprecedented pace and the demand for quick, convenient, and secure financial management solutions surges, the significance of digital wallet applications cannot be overstated. These innovative platforms, also known as mWallets or eWallets, have rapidly emerged as one of the most popular payment methods, enabling users to conduct transactions swiftly and securely without the need for physical currency or cards.

The landscape of digital wallets is continually evolving, shaping a cashless society where managing finances becomes not just a choice, but a safe and seamless experience. According to recent reports, the adoption of digital wallets like Apple Pay and Google Pay has skyrocketed, with projections indicating widespread usage soon.

For businesses, whether startups aspiring to make their mark in a thriving market or enterprises aiming to stay ahead of the curve, digital wallet app development represents a lucrative opportunity. However, embarking on this journey requires a deep understanding of the intricate nuances of mobile payment systems and meticulous planning.

In this comprehensive guide, we delve into every essential aspect of eWallet app development. From exploring the cost implications and must-have features to understanding the development process, technology stack, security compliance, and more, we provide invaluable insights to help you navigate the complexities of digital wallet app development in 2024 and beyond. Join us as we unravel the blueprint for crafting the next-generation digital wallet experience.

What is Digital Wallet?

A digital wallet revolutionizes the way we manage our finances and streamline transactions in our modern, fast-paced world. Essentially, it’s a software application that functions as a virtual counterpart to our traditional physical wallet. With a digital wallet at your fingertips, there’s no need to carry around a bulging wallet filled with cards and documents. Instead, all you require is a smartphone equipped with a designated mobile app.

Setting up a digital wallet is a breeze. After downloading the app onto your smartphone, you simply register your debit or credit card details on the secure platform. These details are encrypted and stored as tokens, along with a unique device identifier known as a cryptogram. When you make transactions or transfers, these tokens and cryptograms serve as virtual identification, ensuring secure and swift payments.

Gone are the days of inserting cards into point-of-sale terminals or laboriously entering security PINs. Digital wallet apps facilitate contactless payments, promoting convenience and efficiency while maintaining robust security measures. As the fintech landscape evolves, digital wallets are becoming more than just repositories for payment methods. They are evolving into comprehensive ecosystems, offering storage for an array of digital items traditionally housed in physical wallets.

From gift cards and loyalty points to boarding passes and event tickets, digital wallets consolidate disparate items into a single, accessible platform. This convergence of functionality not only simplifies our daily transactions but also lays the groundwork for a future where physical wallets may become obsolete.

In essence, digital wallets represent more than just a technological convenience; they signify a paradigm shift in how we interact with our finances and manage our digital lives. As this technology continues to advance, we can expect digital wallets to play an increasingly integral role in shaping the way we navigate the modern world.

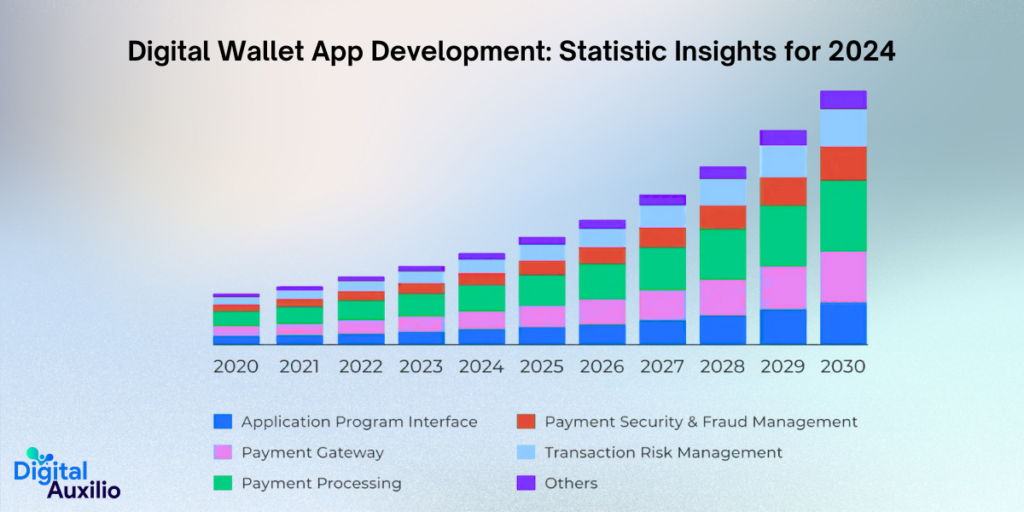

Digital Wallet App Development: Statistic Insights for 2024

Here are some statistics about digital wallet app development in 2024:

- The global mobile wallet market is expected to reach $11.9 billion by 2024.

- The global crypto wallet market is expected to reach $7,036.81 million by 2027, growing at a CAGR of 29.81%.

- By the end of 2024, half of the world’s population will use digital wallets.

- Digital and mobile wallet payments are expected to make up 53% of global online transactions by 2024, up from 49% in 2021.

- The transaction value across the world will cross $9 trillion annually, growing by 80%.

Still not convinced? As a digital wallet app development company, we understand the importance of highlighting the myriad advantages that digital wallets offer to both businesses and customers. Allow us to elucidate a few compelling reasons why creating a digital wallet app can be immensely beneficial:

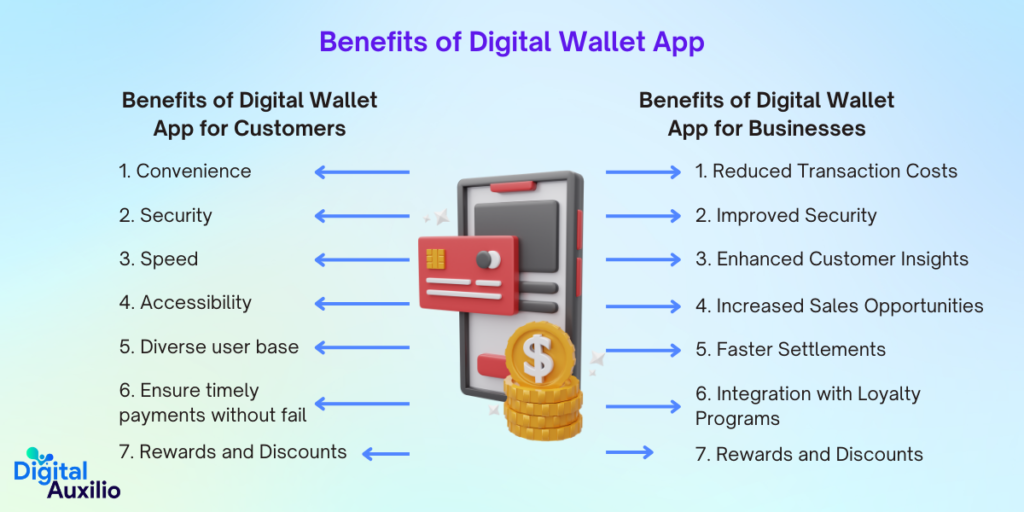

Benefits of Digital Wallet App for Customers

Digital wallet apps offer several benefits to customers, enhancing their convenience and security in managing finances and transactions. Here are some key advantages:

1. Convenience:

Digital wallet apps offer unparalleled convenience by allowing instant transactions without the need to queue at ATMs or counters.

2. Security:

Unlike traditional wallets, digital wallet apps provide enhanced security features, such as encryption and unique access codes, reducing the risk of theft or unauthorized access.

3. Speed:

With digital wallet apps, transactions are swift and effortless, eliminating the need to repeatedly enter card details. Simply scan a QR code or tap your phone to complete payments in seconds.

4. Accessibility:

Your digital wallet resides on your smartphone, ensuring it’s always accessible for day-to-day transactions anytime, anywhere.

5. Diverse user base:

Digital wallet apps cater to a wide range of users, enabling payments for various services, including bills, utilities, transportation, and more, thereby enhancing convenience for all.

6. Ensure timely payments without fail:

Utilizing features like autopay, and digital wallet apps ensure timely bill payments without the risk of missing deadlines, allowing customers to manage their finances hassle-free.

7. Rewards and Discounts:

Many digital wallet apps offer rewards, cashback, and discounts for transactions, incentivizing users to embrace cashless transactions and save money in the process.

Benefits of Digital Wallet App for Businesses

Digital wallet apps offer several benefits for businesses:

1. Reduced Transaction Costs:

Digital wallet transactions typically have lower processing fees compared to traditional payment methods like credit cards. This can result in cost savings for businesses, especially those processing a high volume of transactions.

2. Improved Security:

Digital wallet transactions are encrypted and often require authentication such as a fingerprint or facial recognition, making them more secure than traditional payment methods. Businesses can reduce the risk of fraud and chargebacks associated with credit card transactions.

3. Enhanced Customer Insights:

Digital wallet apps collect valuable data on customer purchasing behavior, preferences, and demographics. Businesses can use this data to better understand their customers and tailor marketing efforts accordingly, leading to more effective targeting and increased customer loyalty.

4. Increased Sales Opportunities:

By offering digital wallet payment options, businesses can tap into new customer segments, including tech-savvy millennials and Gen Z consumers who prefer mobile payment methods. This can expand the customer base and drive sales growth.

5. Faster Settlements:

Digital wallet transactions typically settle faster than traditional payment methods, with funds often available to businesses within hours rather than days. This can improve cash flow and liquidity for businesses, especially small and medium-sized enterprises (SMEs).

6. Integration with Loyalty Programs:

Many digital wallet apps offer integration with loyalty programs, allowing businesses to reward customers for their repeat purchases and encourage customer retention. This can help businesses build long-term relationships with their customers and increase customer lifetime value.

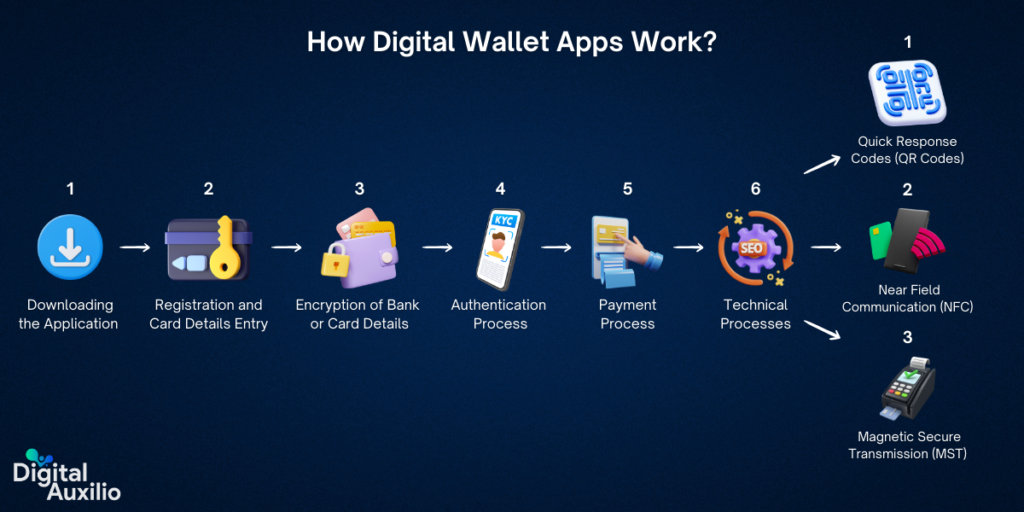

How Digital Wallet Apps Work?

Digital wallet applications have streamlined the way we conduct financial transactions, offering users convenience, security, and efficiency. Let’s delve into how these apps function based on the outlined steps and technical processes:

1. Downloading the Application:

The user begins by downloading a digital wallet application onto their smartphone or compatible device from the respective app store.

2. Registration and Card Details Entry:

Upon installation, the user registers by inputting their personal information and linking their preferred payment methods, such as debit or credit cards, into the application.

3. Encryption of Bank or Card Details:

Once the user enters their card details, the application encrypts this sensitive information, ensuring that it is securely stored within the app and inaccessible to unauthorized individuals.

4. Authentication Process:

To authorize transactions, the user must pass authentication measures integrated into their device’s operating system. This could involve biometric authentication like fingerprint or facial recognition, or entering a PIN or password.

5. Payment Process:

When making a payment using the digital wallet, the user can choose between various methods. They can either hold their smartphone close to a contactless terminal, where near-field communication (NFC) technology facilitates the transaction or opt for payment using their mobile number, with further security processes implemented within the application.

6. Technical Processes:

Behind the scenes, various technical processes enable seamless transactions within the digital wallet app:

1. Quick Response Codes (QR Codes):

QR codes serve as a convenient method for initiating transactions. Users scan these codes using their smartphone cameras, which direct them to access relevant payment information and complete transactions swiftly and effortlessly.

2. Near Field Communication (NFC):

NFC technology enables wireless data transfer between devices in close proximity. In the context of digital wallets, NFC facilitates contactless payments by allowing smartphones and payment terminals to communicate securely, ensuring swift and secure transactions.

3. Magnetic Secure Transmission (MST):

MST technology replicates traditional magnetic stripe systems, enabling users to make payments at terminals that do not support NFC. Particularly useful in regions like the United States where NFC adoption may be slower, MST ensures compatibility with a wide range of merchant payment terminals, enhancing the accessibility and usability of digital wallets.

By leveraging these technical processes, digital wallet applications offer users a seamless and secure payment experience, fostering the adoption of a contactless payment culture while catering to diverse user preferences and regional payment infrastructures.

As an experienced fintech app development Company, we specialize in building and customizing digital wallet applications tailored to meet your unique business needs, ensuring optimal functionality and user satisfaction.

Read more about iOS App Development: Cost, Features, and Benefits Explored

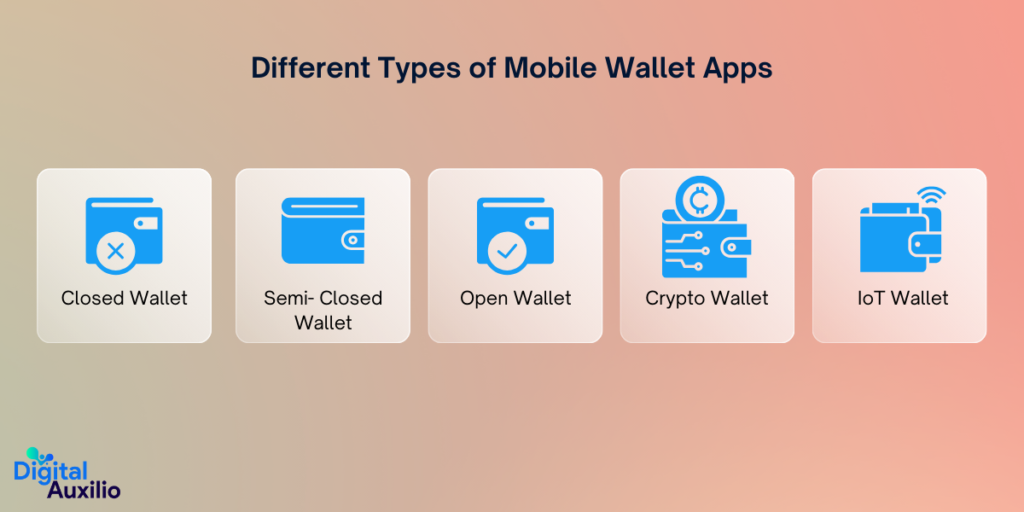

Different Types of Mobile Wallet Apps

In the realm of mobile wallet apps, there exists a diverse array of options tailored to cater to varying user preferences, business models, and technological ecosystems. Understanding these distinctions is crucial for businesses aiming to develop successful digital wallet applications.

Here’s an overview of the different types of mobile wallet apps:

1. Closed Wallet:

Closed wallet apps are typically issued by a specific company or organization for use within its ecosystem only. Users can make transactions, such as purchases or transfers, but usually, the funds are limited to transactions within the issuer’s network. Examples include store-specific digital wallets or those associated with loyalty programs.

2. Semi-Closed Wallet:

Semi-closed wallet apps allow users to perform transactions both within the issuer’s network and with select third-party merchants. While users can use these wallets for a range of transactions, they may still have restrictions on where funds can be spent. Examples include popular payment apps that enable transactions at various merchants but may have limitations on cross-border payments.

3. Open Wallet:

Open wallet apps provide users with more flexibility as they allow transactions across a wide range of merchants and service providers. Users can often link multiple payment methods and use the wallet for various purposes, including peer-to-peer transfers, online shopping, bill payments, and more. Popular examples include widely accepted digital payment platforms like PayPal and Venmo.

4. Crypto Wallet:

Crypto wallets are specifically designed to store, manage, and transact digital currencies such as Bitcoin, Ethereum, and others. These wallets can be either software-based (hot wallets) or hardware-based (cold wallets), offering varying degrees of security and accessibility. Users can send and receive cryptocurrencies, monitor their balances, and manage their digital assets through these wallets.

5. IoT Wallet:

IoT (Internet of Things) wallets are a relatively newer concept, designed to facilitate transactions between interconnected devices. These wallets enable automated payments and transactions between IoT devices, such as smart appliances, wearable gadgets, and autonomous vehicles. They play a crucial role in enabling machine-to-machine transactions and fostering seamless interactions within the IoT ecosystem.

Top Features to Integrate into Your Digital Wallet Application

Here are the top features to integrate into your digital wallet application for each user panel, merchant panel, and admin panel:

1. User Panel Features:

- Account Creation: Allow users to sign up and create their accounts securely.

- Profile Management: Enable users to manage their personal information, payment methods, and security settings.

- Wallet Management: Provide functionality to add, remove, and manage different payment methods/cards.

- Transaction History: Display a comprehensive list of all transactions made through the digital wallet for easy tracking.

- Peer-to-Peer Payments: Facilitate seamless transfer of funds between users of the digital wallet.

- Bill Payments: Allow users to pay their utility bills, mobile recharges, and other bills directly from the app.

- In-App Chat Support: Offer a communication channel within the app for users to reach out for assistance or queries.

- Rewards and Offers: Notify users about exclusive deals, discounts, and rewards available through the app.

- Security Features: Implement robust security measures such as two-factor authentication, biometric authentication, and encryption to ensure the safety of users’ financial data.

- Notifications: Send real-time notifications to users for transaction updates, account activities, and promotional offers.

2. Merchant Panel Features:

- Business Registration: Enable merchants to sign up and register their businesses within the app.

- Product/Service Management: Allow merchants to list and manage their products or services offered through the app.

- Order Management: Provide tools for merchants to track and manage incoming orders placed by users.

- Payment Processing: Facilitate secure payment processing for purchases made by users through the digital wallet.

- Analytics and Reporting: Offer insights into sales performance, customer behavior, and other relevant metrics to help merchants make informed decisions.

- Customer Feedback Management: Allow merchants to collect and respond to feedback and reviews from users.

- Loyalty Programs: Enable merchants to create and manage loyalty programs to incentivize repeat purchases.

- Inventory Management: Assist merchants in managing their inventory levels and stock availability.

- Integration with Point-of-Sale (POS) Systems: Integrate with existing POS systems to streamline in-store transactions.

- Customer Relationship Management (CRM): Provide tools for merchants to build and maintain relationships with their customers.

3. Admin Panel Features:

- User Management: Allow administrators to manage user accounts, including account verification, suspension, or deletion.

- Merchant Management: Enable administrators to onboard, verify, and manage merchant accounts.

- Transaction Monitoring: Provide tools for administrators to monitor and analyze transactional activities for potential fraudulent behavior.

- Content Management: Allow administrators to manage app content, including FAQs, terms of service, and promotional banners.

- Reporting and Analytics: Offer comprehensive reports and analytics on user engagement, transaction volume, and other key metrics.

- Compliance and Regulation: Ensure compliance with relevant regulations and standards governing financial transactions and data security.

- Customer Support: Provide tools for administrators to assist users and merchants with any issues or inquiries.

- System Maintenance: Enable administrators to perform routine maintenance tasks and updates to ensure the smooth functioning of the app.

- Security Controls: Implement additional security controls and access permissions to safeguard sensitive information and prevent unauthorized access.

- Customization Options: Allow administrators to customize the app’s features, branding, and settings to meet specific business requirements.

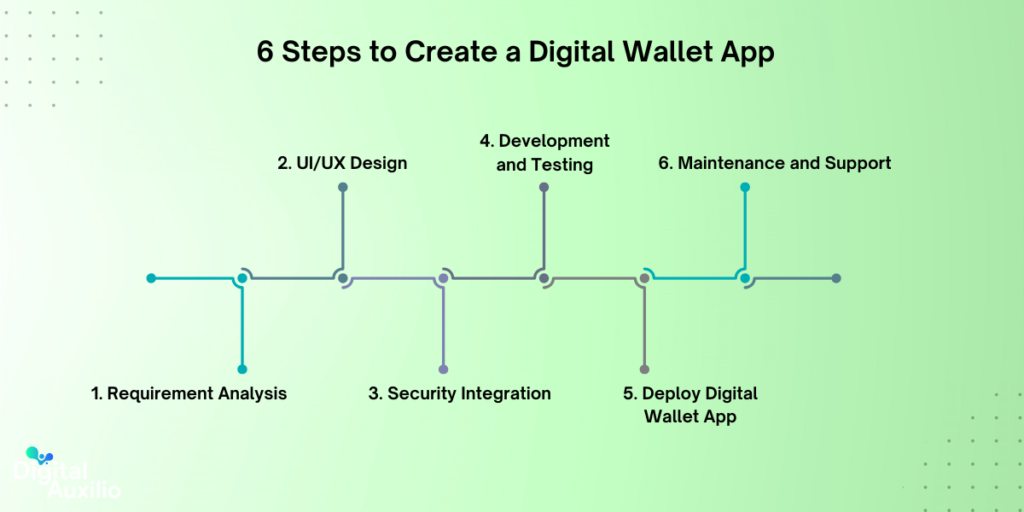

Digital Wallet App Development: Step-by-Step Guide

In the rapidly evolving landscape of mobile app development, creating a digital wallet app demands a strategic and meticulous approach. From conceptualization to deployment, each step plays a crucial role in crafting a seamless user experience and ensuring the app’s success in the market.

Let’s delve into the step-by-step guide for developing digital wallet app that caters to the modern user’s needs and expectation

1. Requirement Analysis:

Begin by defining the goals and objectives of your digital wallet app. Determine the key features you want to incorporate, such as multi-currency support, fund transfers, bill payments, and merchant transactions. Understanding the user requirements is crucial to shaping the direction of your app development process.

2. UI/UX Design:

Craft an intuitive and visually appealing user interface (UI) along with seamless user experience (UX). Design screens that enable users to navigate effortlessly, perform transactions securely, and access their accounts with ease. Prioritize simplicity and clarity in design to enhance user engagement and trust.

3. Security Integration:

Implement stringent security measures to safeguard user data and transactions. Incorporate robust encryption techniques and authentication mechanisms, including biometrics like fingerprint or facial recognition. Address potential vulnerabilities and adhere to industry standards to ensure the highest level of security for your digital wallet app.

4. Development and Testing:

Proceed with the development phase by building the app according to the defined requirements and design specifications. Utilize agile methodologies for efficient development and ensure seamless integration of essential features such as account management, transaction processing, and notification systems. Thoroughly test the app for functionality, security, and performance to identify and rectify any issues before deployment.

5. Deploy Digital Wallet App:

Once development and testing are complete, deploy the digital wallet app to the intended platform, whether it’s iOS, Android, or both. Follow the submission guidelines of respective app stores and adhere to their policies for a smooth deployment process. Monitor the app’s performance post-launch and address any user feedback or issues promptly.

6. Maintenance and Support:

Continuous maintenance and support are essential for the long-term success of your digital wallet app. Regularly update the app to introduce new features, enhance security, and improve performance based on user feedback and market trends. Provide responsive customer support to address user inquiries, resolve issues, and ensure a positive user experience.

By following these step-by-step guidelines, you can navigate through the digital wallet app development process effectively, ultimately delivering a secure, user-friendly, and feature-rich application to your target audience.

Read more about Android App Development Guide: Expert Tips for Success

Top Technology Stack Used For Digital Wallet App Development 2024

As of 2024, digital wallet app development typically leverages a robust technology stack to ensure security, scalability, and seamless user experience.

Here’s a top technology stack commonly used for digital wallet app development:

| Component | Technology Stack |

| Frontend | Kotlin, Swift, HTML 5, CSS, Bootstrap, Vue.js, React.js |

| Backend | Node.js, PHP, Python |

| Cross-platform | React Native or Flutter |

| Database | MongoDB, PostgreSQL |

| Authentication | OAuth 2.0, JWT |

| Payment Gateway | Stripe, PayPal |

| Push Notifications | Firebase Cloud Messaging |

| Security | SSL/TLS, Encryption |

| Cloud Hosting | AWS, Google Cloud |

| Real-time Analytics | Apache Kafka, Spark Streaming |

| QR Codes or Barcode Scanning: | ZXing, React Native QR Code Scanner, ByteScout BarCode, ZBar Code Reader |

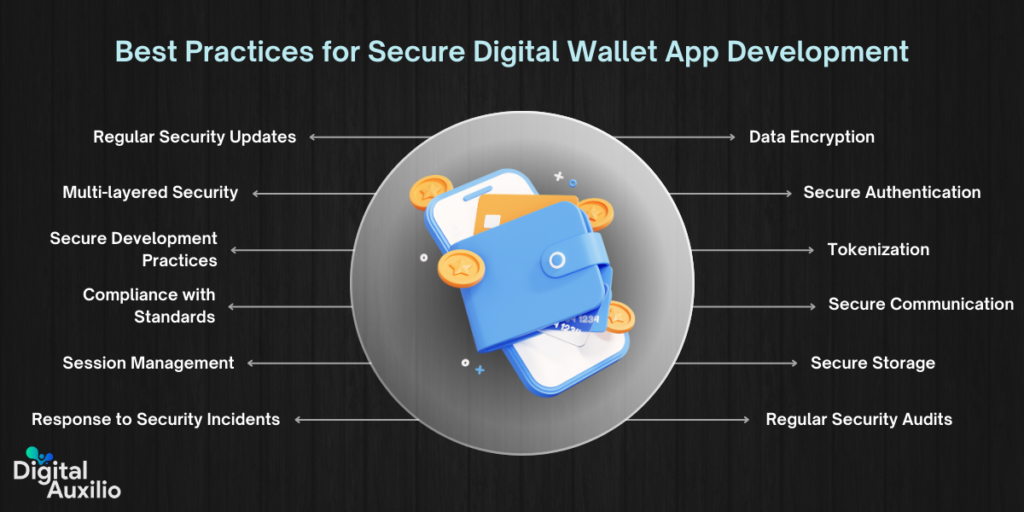

Best Practices for Secure Digital Wallet App Development

Developing a secure digital wallet app requires a comprehensive approach to ensure the protection of users’ sensitive financial information. Here are some best practices for secure digital wallet app development:

1. Data Encryption:

Implement end-to-end encryption for all data transmission and storage. Utilize strong encryption algorithms such as AES (Advanced Encryption Standard) to safeguard user data, including payment credentials, transaction details, and personal information.

2. Secure Authentication:

Employ robust authentication mechanisms, such as biometric authentication (fingerprint, face recognition) or multi-factor authentication (MFA), to verify users’ identities before granting access to the app. Avoid relying solely on passwords, as they are prone to brute-force attacks and phishing.

3. Tokenization:

Utilize tokenization to replace sensitive data (e.g., credit card numbers) with unique tokens. This minimizes the risk of exposing actual payment information in case of a breach.

4. Secure Communication:

Use HTTPS/TLS protocols to ensure secure communication between the app and backend servers. Implement certificate pinning to prevent man-in-the-middle attacks and verify the authenticity of server certificates.

5. Secure Storage:

Store sensitive data securely on the device using methods like the Android Keystore or iOS Keychain. Employ secure storage practices to protect data at rest from unauthorized access or extraction.

6. Regular Security Audits:

Conduct regular security audits and penetration testing to identify vulnerabilities and weaknesses in the app’s infrastructure and codebase. Address any discovered issues promptly to maintain a robust security posture.

7. Regular Security Updates:

Keep the app up-to-date with the latest security patches and updates to address known vulnerabilities in third-party libraries, frameworks, and the underlying operating system.

8. Multi-layered Security:

Implement multiple layers of security controls such as network firewalls, intrusion detection/prevention systems (IDS/IPS), and runtime application self-protection (RASP) to detect and prevent security threats at different levels.

9. Secure Development Practices:

Adhere to secure coding practices such as input validation, output encoding, and proper error handling to mitigate common vulnerabilities like injection attacks (e.g., SQL injection, XSS).

10. Compliance with Standards:

Ensure compliance with relevant security standards and regulations such as PCI-DSS (Payment Card Industry Data Security Standard) for handling payment card data and GDPR (General Data Protection Regulation) for protecting user privacy.

11. Session Management:

Implement secure session management techniques to prevent session hijacking and unauthorized access. Use techniques like session tokens with short expiration periods and enforce re-authentication for sensitive transactions.

12. Response to Security Incidents:

Develop a comprehensive incident response plan to handle security breaches or incidents effectively. Define procedures for incident detection, containment, eradication, and recovery to minimize the impact on users and the reputation of the app.

Top Digital Wallet Apps Globally

Digital wallet apps have revolutionized the way we handle money transactions, offering convenience, security, and efficiency.

Here are some of the top digital wallet apps globally, along with key statistics showcasing their impact:

1. PayPal

- PayPal is one of the pioneers in digital payments, offering a seamless platform for online transactions.

- It boasts over 400 million active user accounts worldwide.

- With support for over 200 countries and over 25 currencies, PayPal has a vast global reach.

2. Apple Pay

- Apple Pay offers a convenient and secure way to make payments using Apple devices such as iPhones, iPads, and Apple Watches.

- It has over 507 million users globally and continues to expand its reach to new markets.

- In 2020, Apple Pay transaction volume reached over $380 billion, demonstrating its growing popularity and trust among users.

3. Google Pay

- Google Pay provides a seamless payment experience for Android users, allowing them to pay in stores, and online, and send money to friends and family.

- It boasts over 150 million users globally and is gaining traction in various regions.

- Google Pay processes over $100 billion in transactions annually, showcasing its significant contribution to the digital payments ecosystem.

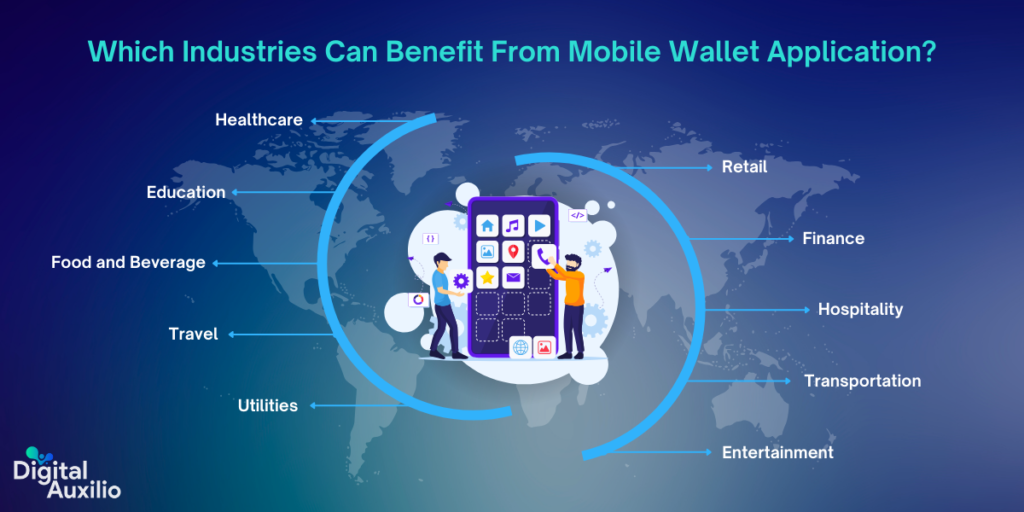

Which Industries Can Benefit From Mobile Wallet Application?

Numerous industries stand to gain significant benefits from the adoption and utilization of mobile wallet applications. Here’s some of them:

1. Retail:

Mobile wallets streamline transactions, offering convenience and security to customers while reducing checkout times for retailers. Integration with loyalty programs also enhances customer engagement and retention.

2. Finance:

Mobile wallets facilitate seamless money transfers, bill payments, and peer-to-peer transactions. They also enable access to financial services for the unbanked or underbanked population, fostering financial inclusion.

3. Hospitality:

In the hospitality industry, mobile wallets expedite check-in/check-out processes, enable contactless payments for room service, and enhance guest experience through personalized offers and loyalty rewards.

4. Transportation:

Mobile wallets simplify ticket purchases for public transportation systems, parking fees, and ride-sharing services. They also enable seamless integration with loyalty programs and offer incentives for frequent travelers.

5. Entertainment:

Event ticketing platforms leverage mobile wallets to facilitate ticket purchases, streamline entry processes, and deliver personalized experiences such as exclusive access to VIP areas or pre-sale offers.

6. Healthcare:

Mobile wallets in healthcare enable patients to securely store and access medical records, schedule appointments, and make payments for medical services. They also support health insurance claims processing and medication reminders.

7. Education:

Educational institutions utilize mobile wallets for fee payments, campus card functionalities (such as access control and meal plans), and distributing digital course materials, enhancing convenience for students and administrators alike.

8. Food and Beverage:

Mobile wallets offer seamless ordering and payment options for food delivery and restaurant services. Loyalty programs integrated into these applications can incentivize repeat business and drive customer engagement.

9. Travel:

Mobile wallets provide travelers with a convenient way to store travel documents, such as boarding passes and hotel reservations, and make payments in different currencies without the hassle of currency exchange fees.

10. Utilities:

Mobile wallets simplify bill payments for various utilities such as electricity, water, and internet services. They also enable users to track their usage, receive notifications, and manage subscriptions seamlessly.

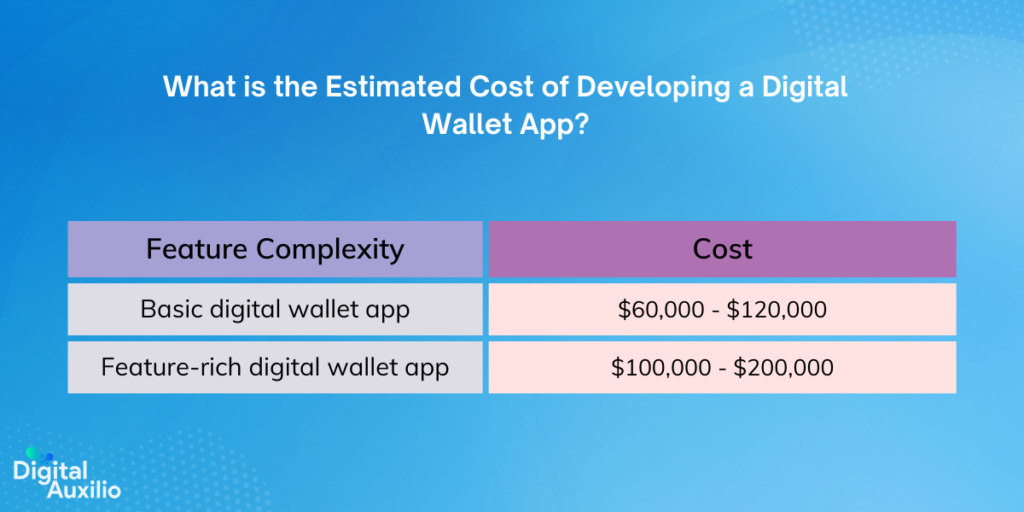

What is the Estimated Cost of Developing a Digital Wallet App?

The cost of developing a digital wallet app can vary significantly depending on various factors such as features, complexity, platform, and development team rates. Here’s a breakdown of estimated costs:

1. Basic Features:

- User registration and authentication: $5,000 – $10,000

- Account management (view balance, transaction history): $5,000 – $8,000

- Secure payment gateway integration: $8,000 – $15,000

2. Advanced Features:

- Multi-currency support: $5,000 – $10,000

- QR code scanning for payments: $3,000 – $6,000

- Push notifications: $2,000 – $5,000

3. Design:

- UI/UX design: $5,000 – $15,000 (depending on complexity and customization)

4. Development:

- iOS app development: $15,000 – $40,000

- Android app development: $15,000 – $40,000

- Backend development: $20,000 – $50,000

5. Testing and Quality Assurance:

- Testing across multiple devices and platforms: $5,000 – $10,000

- Bug fixing and quality assurance: $5,000 – $10,000

6. Additional Costs:

- Maintenance and updates: 10% – 20% of the total development cost annually

- Server hosting and maintenance: $1,000 – $3,000 per month

Total Estimated Cost Range:

- For a basic digital wallet app: $60,000 – $120,000

- For a feature-rich digital wallet app: $100,000 – $200,000

It’s important to note that these are rough estimates and the actual cost may vary based on individual project requirements, development rates in different regions, and unforeseen challenges during the development process. Working closely with a development team to outline specific features and functionalities can help in getting a more accurate cost estimate.

Factors Affect the Cost of Digital Wallet App Development

The cost of digital wallet app development can vary significantly based on several factors. Here’s an explanation of the key factors that influence the overall cost:

- Platform: Choice between iOS, Android, or both impacts development costs.

- Features and functionality: The complexity of payment processing, security, and integrations affects expenses.

- UI/UX design complexity: Elaborate design requirements may increase development costs.

- Development team’s hourly rates and location: Rates vary based on expertise and geographical location.

- Third-party integrations: Integrating external services like payment gateways adds to expenses.

- Compliance and regulations: Meeting standards such as PCI DSS or GDPR necessitates additional resources.

- Testing and quality assurance efforts: Rigorous testing contributes to development expenses.

- Maintenance and updates: Ongoing support post-launch incurs additional costs.

- Project timeline and urgency: Expedited development schedules may require more resources.

- Customization requirements: Tailoring the app to specific needs affects development costs.

- Scalability considerations: Planning for future growth may increase initial expenses.

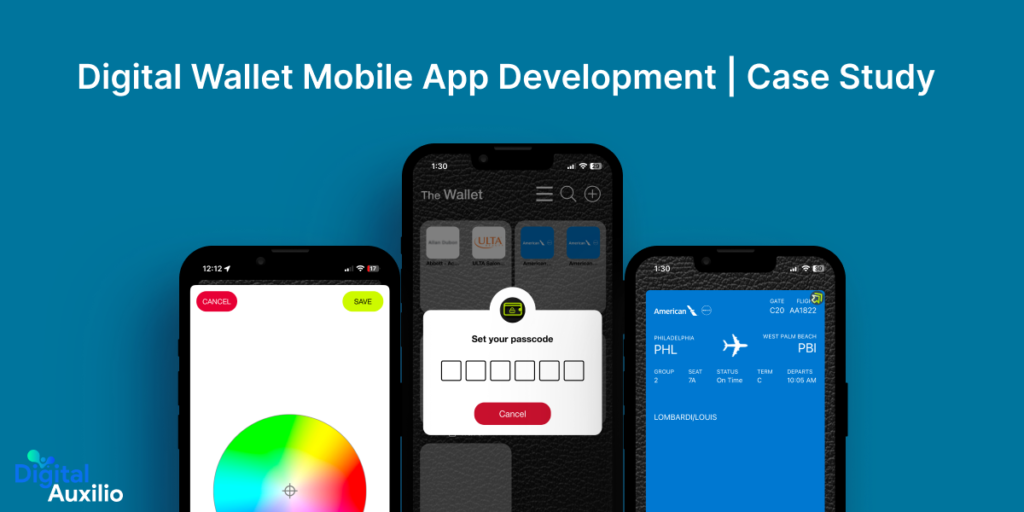

Digital Wallet Mobile App Development | Case Study

In the fast-paced digital era, convenience and accessibility are paramount for users worldwide. Traditional wallets are gradually being replaced by digital alternatives, offering a seamless experience for managing various cards and passes. One such innovative solution is the Mobile Wallet Cards app, which aims to redefine the digital wallet experience across multiple platforms, catering to a global audience.

App Overview

Mobile Wallet Cards introduces a novel approach to digital asset management, allowing users to instantly add their cards to their smartphone’s wallet through QR scanning or simple link clicks. The app’s front-end boasts vibrant visuals and engaging content, while the back-end serves as a hub for an array of customer utilities and features, going beyond conventional use cases like boarding passes or loyalty program cards.

Challenges and Solutions

1. Platform Compatibility: A significant challenge was ensuring compatibility across various platforms, including iPhones, iPads, Android devices, and tablets. While Apple Wallet predominantly caters to iPhone users, the goal was to target a global audience. The solution involved dynamic support for all platforms, utilizing technologies like Swift for iOS and Kotlin for Android development.

2. UI/UX Design Consistency: With limited documentation on UI/UX design patterns, maintaining consistency across different devices posed a challenge, especially for larger screens like iPads and tablets. The team tackled this by implementing basic features and adopting major UI perspectives, ensuring a seamless user experience across all devices.

3. Complex Data Structures: The integration of PkPass presented complexities due to its extensive JSON data structure and diverse card types (e.g., event passes, coupons, store cards). Matching design elements for each card type was challenging initially. However, meticulous attention to detail and adaptation to evolving data structures facilitated smoother development.

4. Beacon Setup: Implementing beacon setup encountered obstacles due to mobile OS restrictions and hardware limitations, leading to intermittent detection issues. Through careful navigation of these challenges, the team successfully managed beacon setup, ensuring optimal functionality within fixed beacon ranges.

5. GeoFencing Integration: The integration of GeoFencing offered valuable location-based features for users and marketing purposes. However, OS limitations regarding maximum GeoFencing monitor counts posed challenges. Mitigating these limitations involved strategic planning and optimization of GeoFencing functionalities.

6. Enhanced Features: Mobile Wallet Cards introduced innovative features, such as customizable backfield details and prioritization of frequently used options on the pass design. While enhancing user convenience, implementing these features required meticulous planning and seamless integration within the existing framework.

Tech Stack

- Frontend: HTML5 for dynamic and interactive user interfaces.

- Backend: Laravel for robust server-side application logic.

- Database: MySQL for efficient data storage and retrieval.

- Authentication: Web 3.0 for secure user authentication and authorization.

- Payment Gateway: PayPal integration for seamless transactions.

- Push Notifications: Firebase PushNotification for real-time communication with users.

- Cloud Hosting: Leveraging scalable cloud hosting solutions for seamless performance.

- Real-time Analytics: Utilizing Google Analytics alongside custom development for comprehensive analytics insights.

- QR Codes/Barcode Scanning: Implementing native operations for efficient scanning capabilities.

- iOS: Utilizing Swift for iOS app development.

- Android: Employing Kotlin for Android app development.

In Conclusion

Navigating the realm of digital wallet app development demands a thorough understanding of the landscape, encompassing the intricacies of user experience, security protocols, and emerging technologies. With the exponential growth in digital transactions, businesses are increasingly recognizing the imperative to integrate robust payment solutions into their platforms.

As a digital wallet development company, Digital Auxilio stands at the forefront, equipped with the expertise and experience to craft tailored solutions that meet the evolving needs of modern consumers and businesses alike. Our commitment to excellence in digital wallet development and payment application development is underscored by our dedication to delivering seamless, secure, and user-centric experiences.

Whether you’re embarking on your first foray into the digital payments space or seeking to enhance your existing offerings, Digital Auxilio provides a comprehensive suite of services. From conceptualization to execution, our team of dedicated developers is poised to collaborate with you every step of the way.

Ready to revolutionize your digital payment ecosystem? Contact us today to embark on a transformative journey towards unlocking the full potential of digital commerce.

FAQs

1. What is a digital wallet app?

A digital wallet app is a software application that allows users to store, manage, and transact various forms of digital currencies or assets securely using their mobile devices.

2. What are the key features of a digital wallet app?

Key features typically include secure login/authentication, digital currency storage, transaction history, QR code scanning, peer-to-peer transfers, integration with payment gateways, and multi-factor authentication.

3. How does a digital wallet app ensure security?

Digital wallet apps employ various security measures such as encryption techniques, biometric authentication, secure servers, tokenization, and regular security audits to safeguard users’ funds and personal information.

4. What types of digital currencies can be supported by a wallet app?

Digital wallet apps can support a wide range of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as fiat currencies like USD, EUR, and GBP.

5. What is the process of developing a digital wallet app?

The development process involves market research, conceptualization, UI/UX design, development (front-end and back-end), integration of security features, testing, and deployment to app stores.

6. How long does it take to develop a digital wallet app?

The development timeline varies depending on factors like complexity, features, platform (iOS, Android, web), and the development team’s expertise. Typically, it can take anywhere from a few months to a year.

7. What are the regulatory considerations for developing a digital wallet app?

Developers need to comply with regulations related to data protection, anti-money laundering (AML), know your customer (KYC), and financial licensing requirements in the regions where the app will be available.

8. Can a digital wallet app integrate with other financial services?

Yes, digital wallet apps can integrate with various financial services such as banking, lending, investment, and remittance services to offer users a comprehensive financial management experience.

9. How do digital wallet apps make money?

Digital wallet apps can generate revenue through transaction fees, subscription models, in-app advertisements, partnerships with merchants, and offering premium features or services.

10. What are the challenges in developing a digital wallet app?

Challenges include ensuring regulatory compliance, building a secure infrastructure, addressing scalability issues, providing excellent user experience, and gaining users’ trust in handling their finances digitally.

11. Why should businesses invest in digital wallet app development in 2024?

Investing in digital wallet app development presents significant opportunities to attract new customers, foster loyalty, and open new revenue streams in the evolving eCommerce landscape.

Add comment